The article series, titled Consumer & Community Context, features original analysis that includes a look at traditionally underserved and economically vulnerable households and neighborhoods, the Fed noted in its announcement. The goal of the series is to increase public understanding of the financial conditions and concerns of consumers and communities.

Authors contributing to the series are employees of the Federal Reserve Board or the Federal Reserve System. “Our objective is to share insights and provide context for the complex economic and financial issues that affect individuals, communities, and the broader economy,” according to a quote from Eric Belsky, director of the Board’s Division of Consumer and Community Affairs, in Wednesday’s announcement.

The first issue of Consumer & Community Context includes two articles: “Can Student Loan Debt Explain Low Homeownership Rates for Young Adults?” and “‘Rural Brain Drain’: Examining Millennial Migration Patterns and Student Loan Debt.”

In the first, staffers from the Fed Board’s research and statistics division find that the increase in student loan debt between 2005 and 2014 reduced the homeownership rate among young adults by 2 percentage points. The homeownership rate for this group fell 9 percentage points overall during this period, “implying that a little over 20 percent of the overall decline in homeownership among the young can be attributed to the rise in student loan debt,” they wrote. “This represents over 400,000 young individuals who would have owned a home in 2014 had it not been for the rise in debt.”

The writers note that a future article will show that, all other things being equal, “higher student loan debt early in life leads to a lower credit score later in life.”

In the second article, staff from the Fed Board’s consumer and community affairs division look at the impact of student loan debt on individuals’ decisions to live in a rural or urban area. They work from the Equifax/Federal Reserve Bank of New York Consumer Credit Panel (CCP), which contains credit reporting data, age, and census tract location for a nationally representative 5% sample of all adults with a Social Security number and a credit report. Key observations, explained in greater detail later in the article, are as follows:

- Those with student loan debt are less likely to remain in rural areas than those who have no such debt. Only 52% of rural student loan borrowers still live in rural areas six years after entering the CCP, compared with about 66% of non-borrowers.

- Individuals in the highest quartile of outstanding student loan balances are the most likely to leave rural areas. Just 37% of rural individuals in the highest quartile of student loan balances remain in rural areas one year after entering repayment, compared to 73% of those in the lowest quartile of student loan balances.

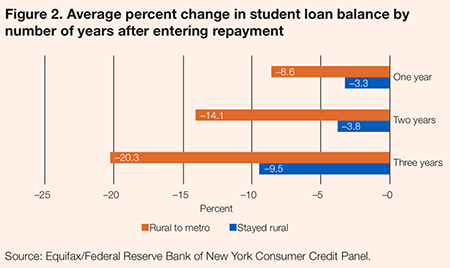

- Within the period studied, rural individuals who move to metro areas fare better than those who stay in rural areas across several financial and economic measures, including student loan delinquency rates and balance reduction.

“The loss of college educated young people could have important effects on the economic vitality of rural areas and raises questions about what rural policymakers could do to retain a larger share of these individuals,” the article states.

Consumer & Community Context (January 2019)